Coverage of all major auto insurance providers

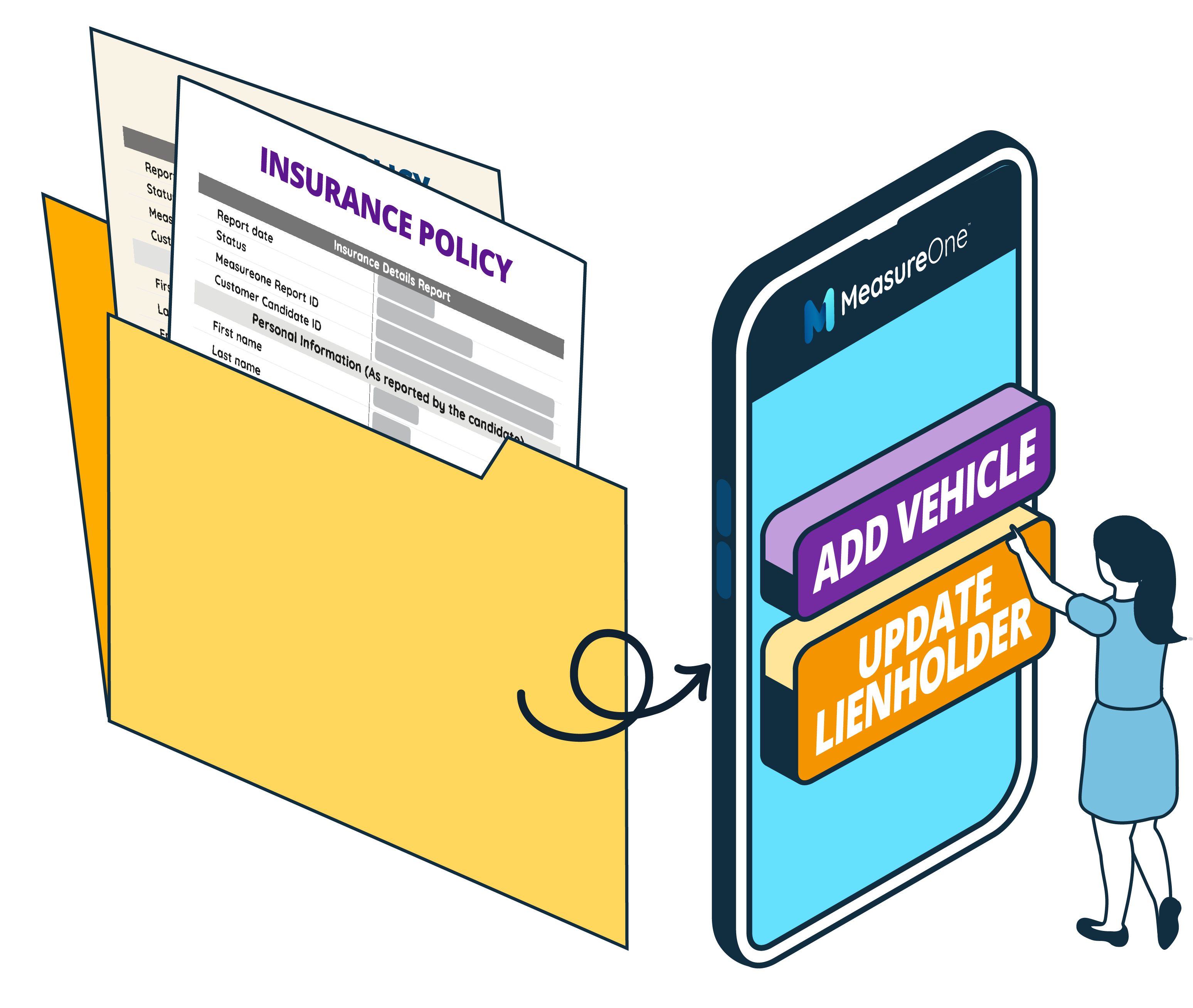

Auto Insurance Policy Updating API

Remove bottlenecks in the car buying journey by automating the Add Vehicle and Update Lienholder process.

How Auto Insurance Policy Updating Works

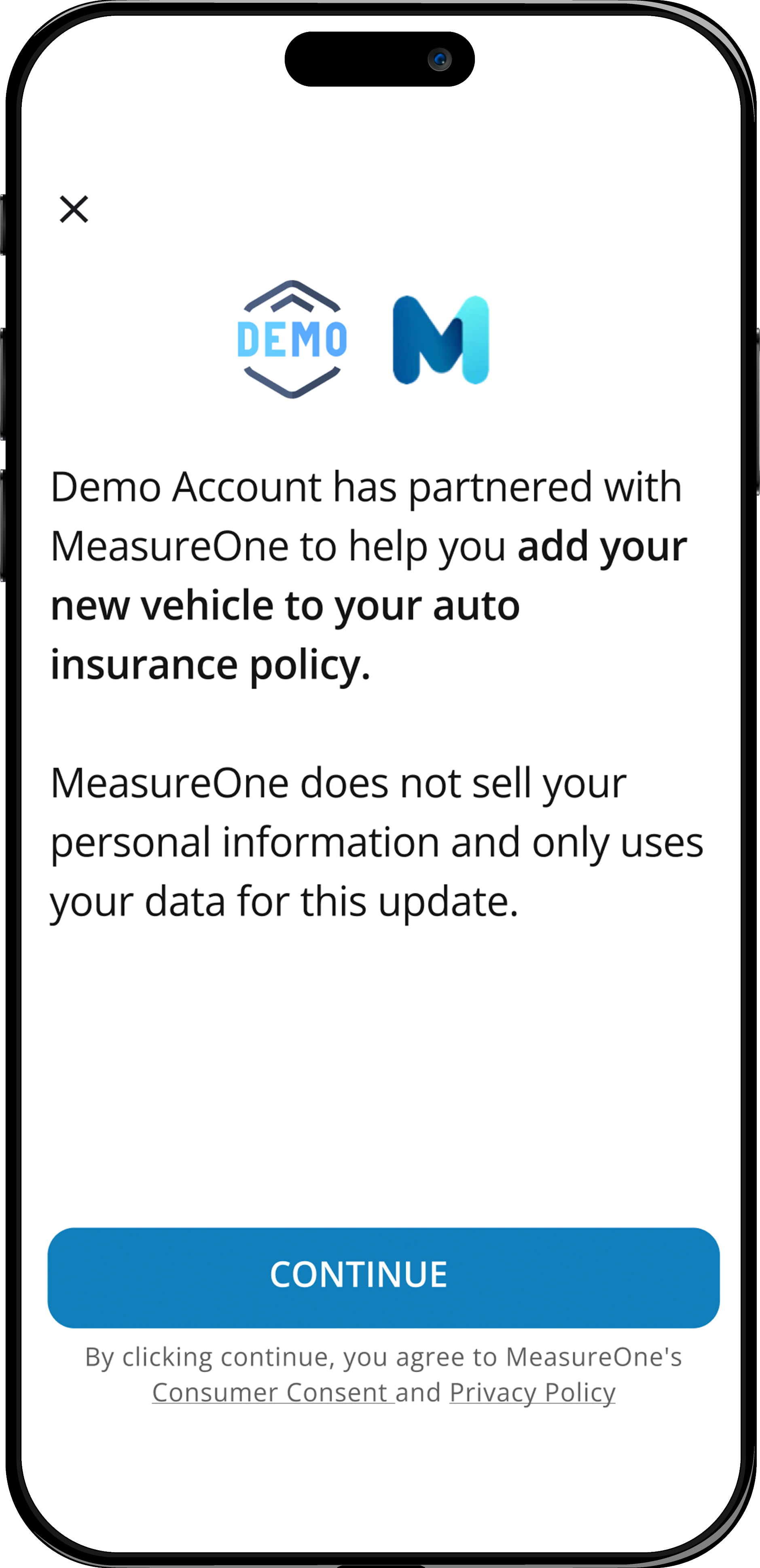

1

The consumer gives permission to MeasureOne to access their auto insurance data to a) Add a Vehicle and b) Update Lienholder

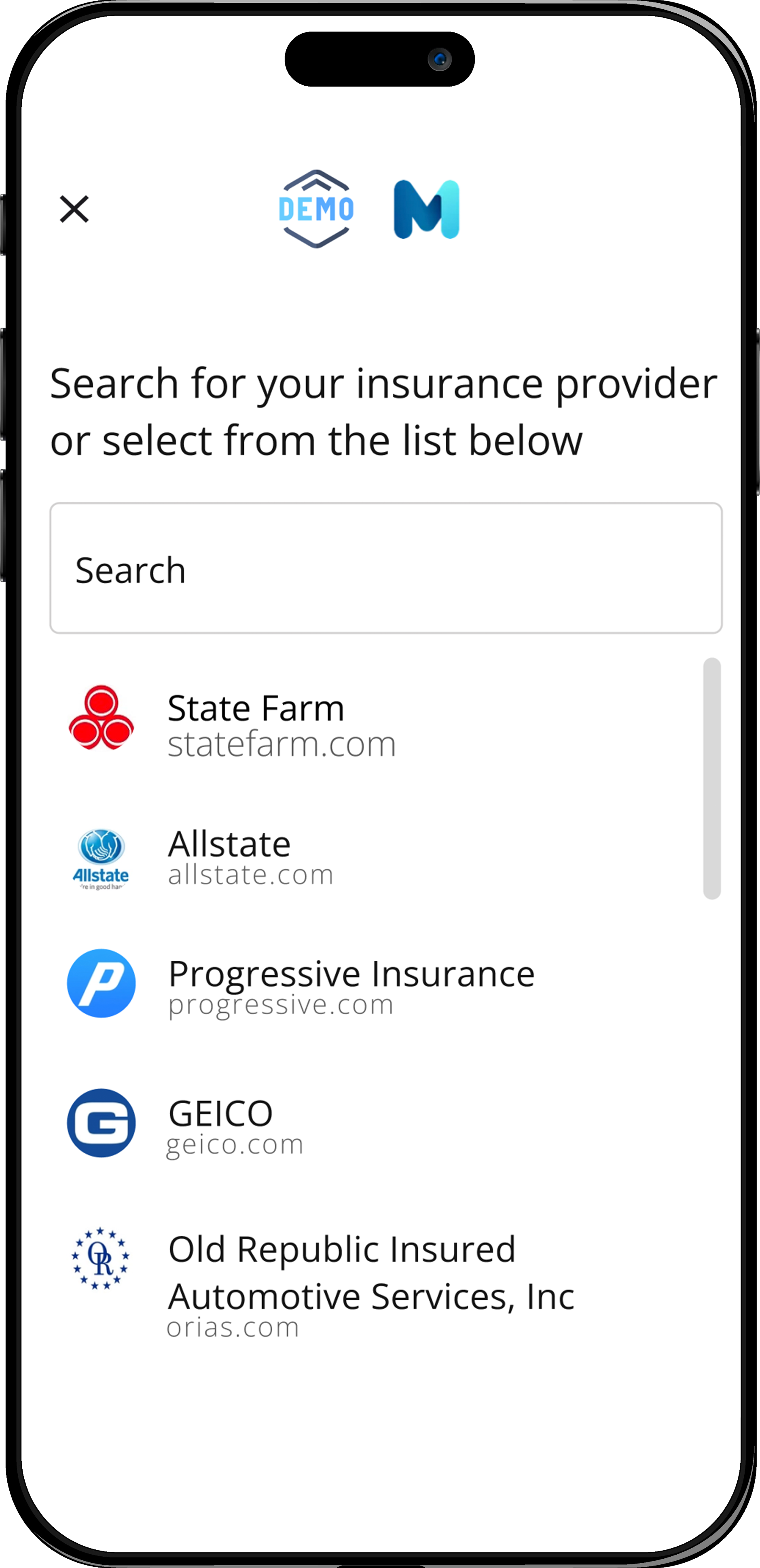

2

The consumer searches for their insurance carrier, selects the appropriate one, and logs in

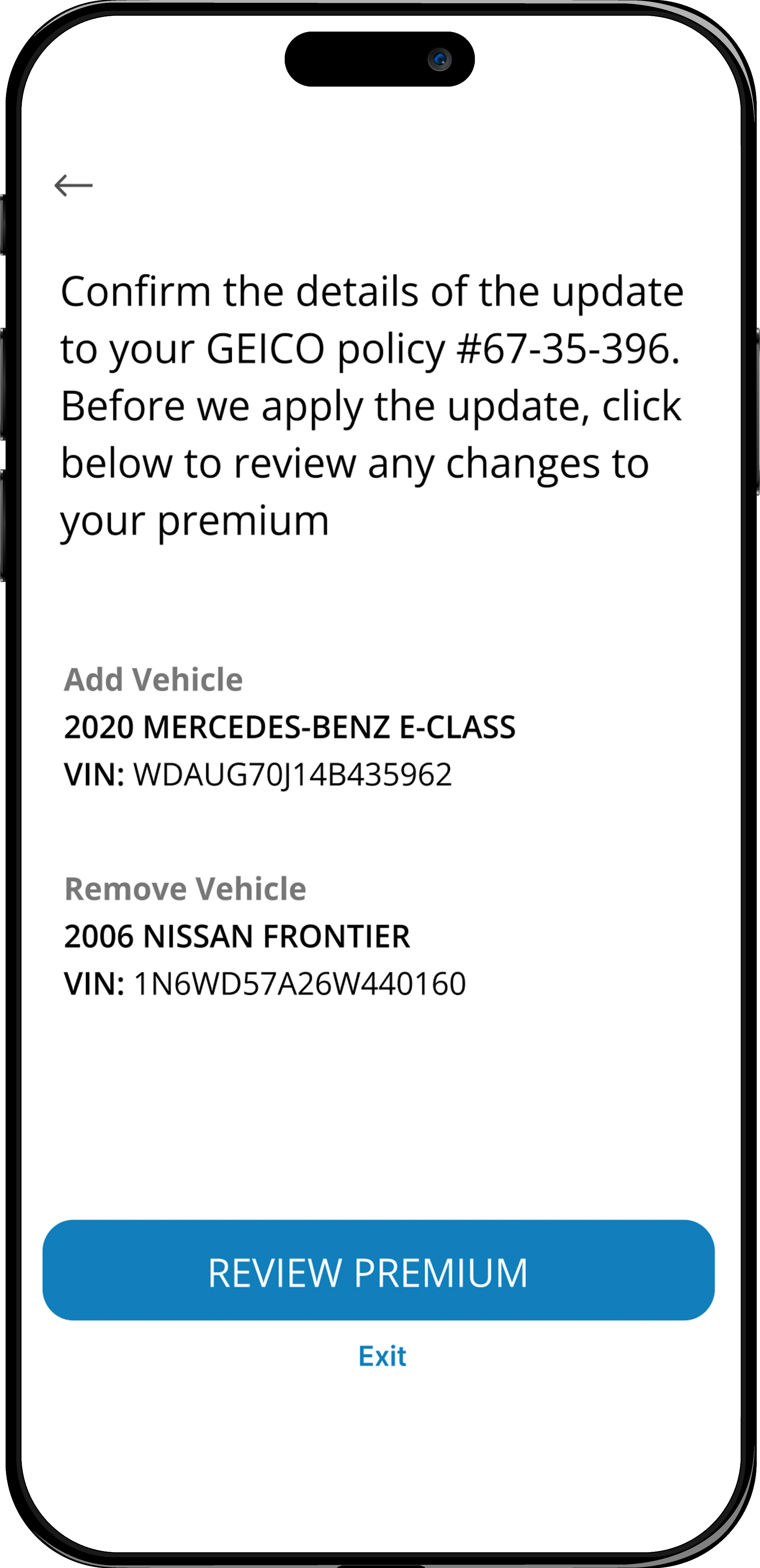

3

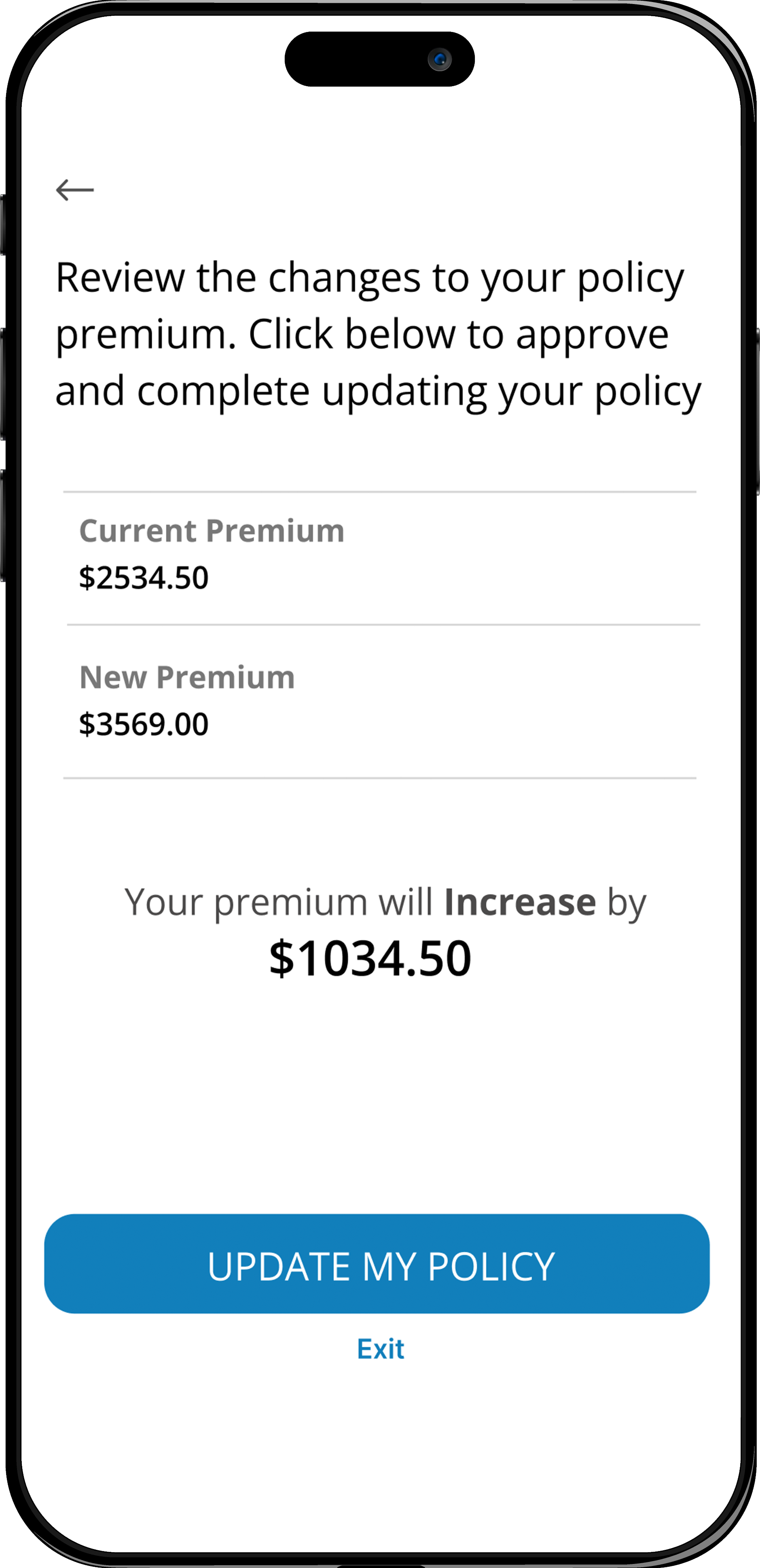

MeasureOne displays the requested changes to the policy, including which vehicle(s) to be added or removed.

4

Changes to the premium are calculated and the consumer can now confirm the update

5

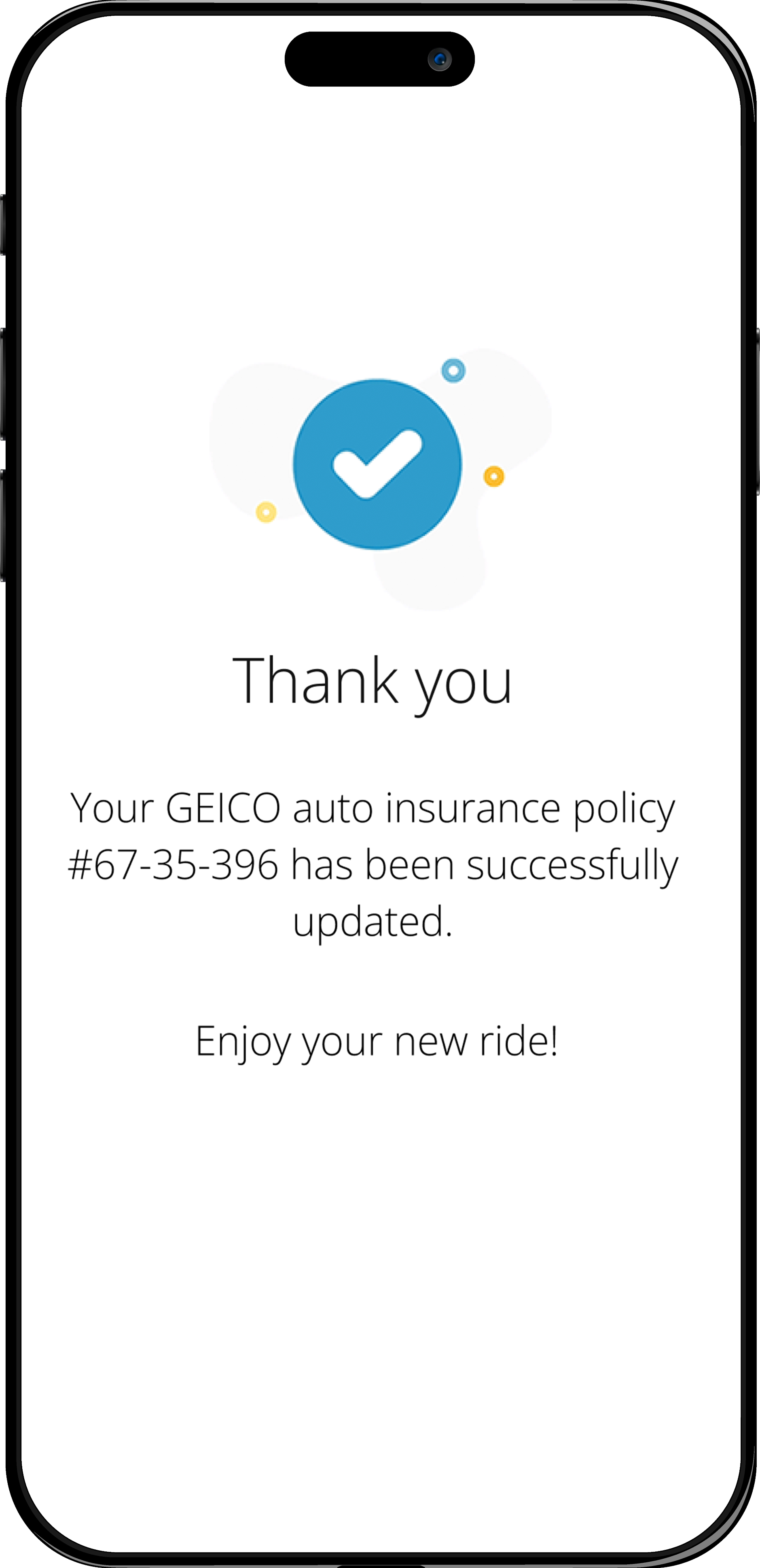

Success! The auto insurance policy updates are completed instantly leading to more sales on the lot.

Ready to get started?

Let us show you a smarter way to access and verify consumer data for your business

Markets Using Auto Insurance Policy Updating

Get accurate and cost-effective policy updating including Add Vehicle and Update Lienholder to grow your business

Insurance Agents

Use auto insurance policy updating to quote and bind policies and enhance your insurance underwriting.

Auto Finance

Close loans faster with automated Add Vehicle or Update Lienholder workflows for every borrower.

Car Dealerships

Remove bottlenecks in the car buying journey, enhance F&I Processes, and close more sales.

Download the Ebook: The essential guide to automating access to auto insurance data

What You'll learn:

- Traditional auto insurance data collection methods and their systemic inaccessibility

- How your industry can benefit from automated access to insurance data

- How to easily take advantage of automation for instant access to auto insurance data

Benefits of Auto Insurance Policy Updating with MeasureOne

Faster processing times

Update auto insurance policies in seconds

Deterministic Document Processing with AI

Get best-in-class document parsing and processing with an optimal combination of deterministic doc processing and AI

Competitive Pricing

A low-cost, instant alternative

Easy Set-up

We offer flexible deployment options to fit your business needs

Data you want

Update a lienholder instantly during financing and/or add a vehicle to a policy on the lot

Consumer privacy guarantee

All data is shared with the consumer's permission

Extensible platform

Easily expand into new geographies, data types, and more

Grow your business

Reduce your costs, increase your margins, and enjoy a seamless workflow that integrates directly into your existing processes

95%+

Coverage of Insurance

100%

Support for all major insurance providers

4.2M+

Documents Processed

Getting Started is Easy

From small business to enterprise, integration solutions for everybody

MeasureOne Dashboard

No-code required to request, access, and verify the data you need in one centralized location

3rd Party Platforms

MeasureOne integrates with third party platforms allowing for easier integration and deployment using your existing operational workflow

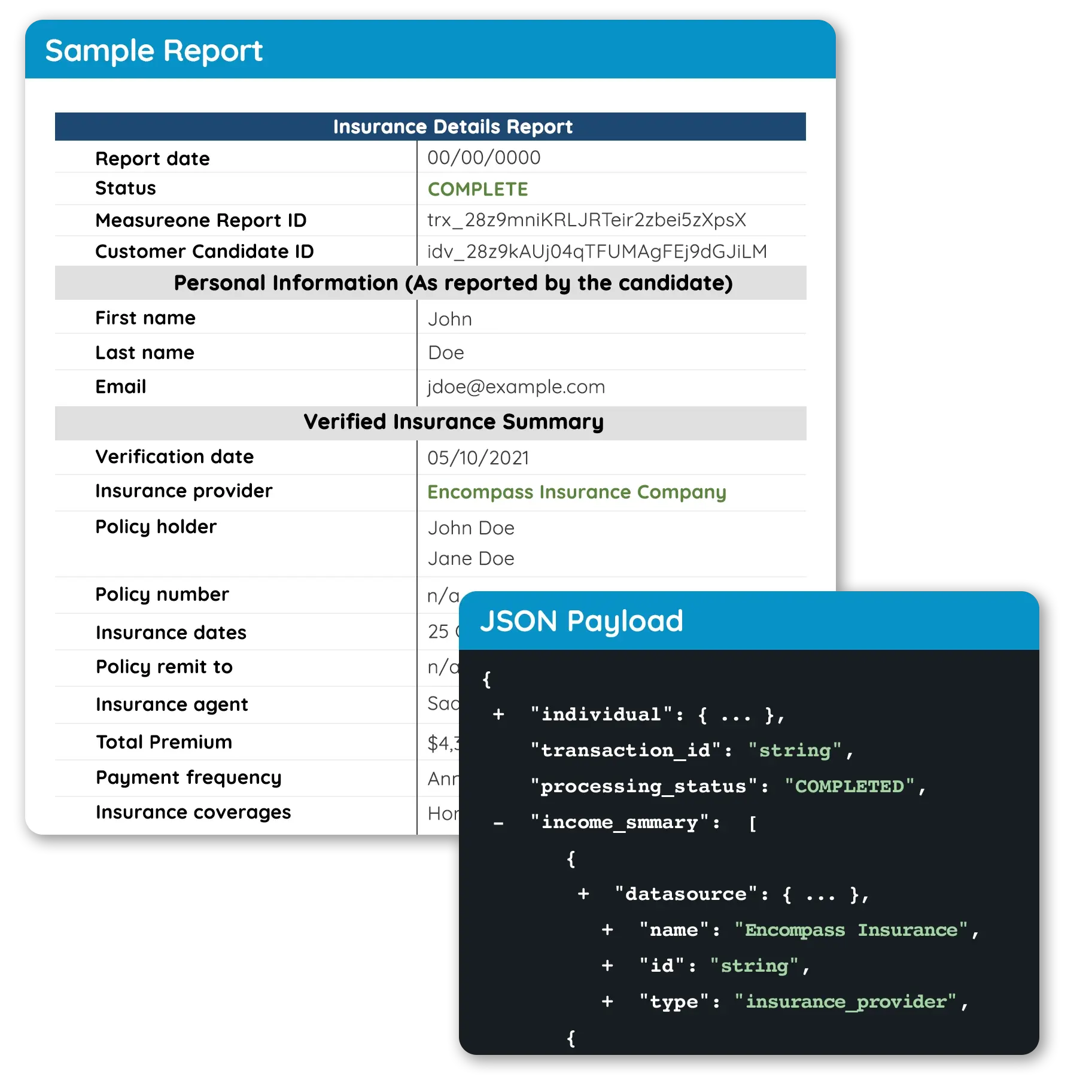

API

Integrate the consumer experience natively into your application. Results will automatically populate your platform

Flexible Reporting Options

Reports are 100% configurable to your business needs

Get any data from a user's online auto insurance account

Access real-time, up to date data with the highest level of accuracy directly from a user's online auto insurance account

Policy number, total premium and payment schedule

Dates of coverage

VIN of insured vehicle

Ready to automate?

Let us show you a better way to access and verify consumer data for your business